- President Biden's proposed hike in the capital gains tax rate could hurt high-flying stocks, according to Goldman Sachs.

- "High-momentum 'winners' that had delivered the largest gains to investors ahead of the rate hike have usually lagged," Goldman said.

- The 10 stocks listed below have generated eye-popping capital gains over the past year and could suffer if Biden's tax plan is enacted.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A proposed capital-gains tax hike by President Joe Biden is nothing the stock market can't handle, according to a Friday note from Goldman Sachs' David Kostin.

But some stocks would be more susceptible to losses than others if the proposed tax hike to 39.6% for those making more than $1 million went into effect, according to the note.

"High-momentum 'winners' that had delivered the largest gains to investors ahead of the rate hike have usually lagged," Kostin explained. Over the last few years, stocks within the technology and consumer discretionary sectors have been that largest source of capital gains, meaning those sectors might lag if the tax hike is approved.

These are the ten S&P 500 companies that have delivered substantial capital gains over the past year and would likely lag the broader market if Biden's capital gains tax hike is enacted, according to Goldman Sachs.

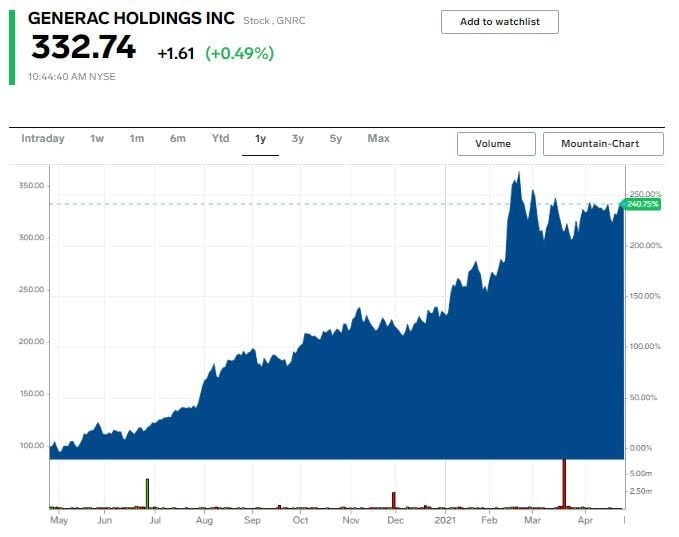

10. Generac

Ticker: GNRC

1-Year Return: 233%

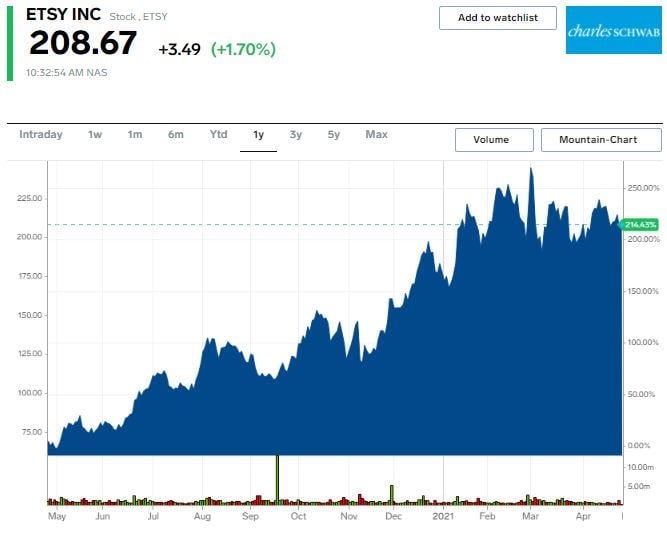

9. Etsy

Ticker: ETSY

1-Year Return: 235%

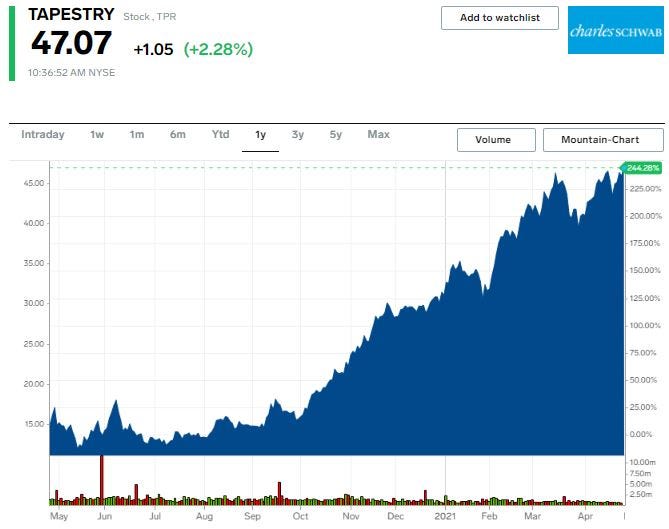

8. Tapestry

Ticker: TPR

1-Year Return: 237%

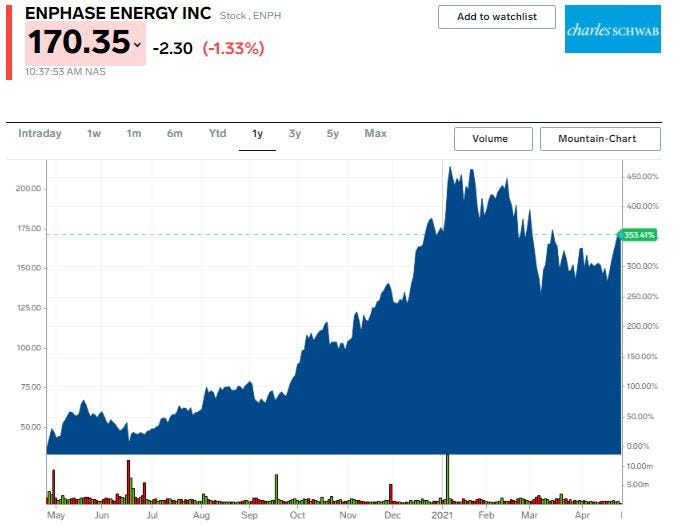

7. Enphase Energy

Ticker: ENPH

1-Year Return: 321%

6. Freeport-McMoRan

Ticker: FCX

1-Year Return: 355%

5. Gap

Ticker: GPS

1-Year Return: 368%

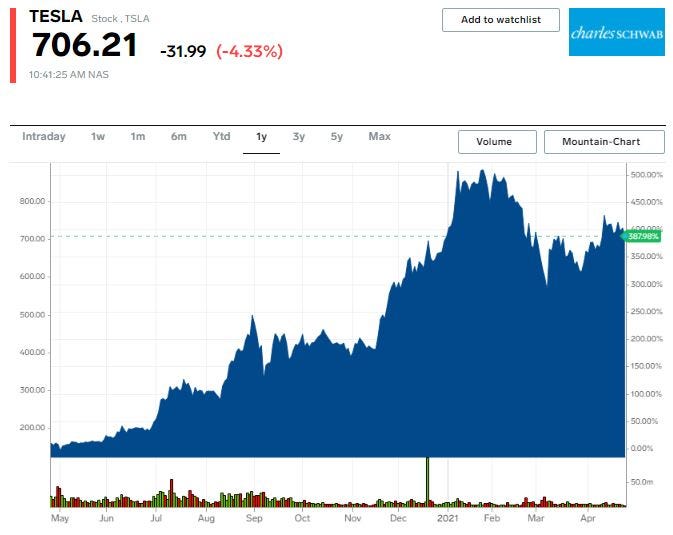

4. Tesla

Ticker: TSLA

1-Year Return: 392%

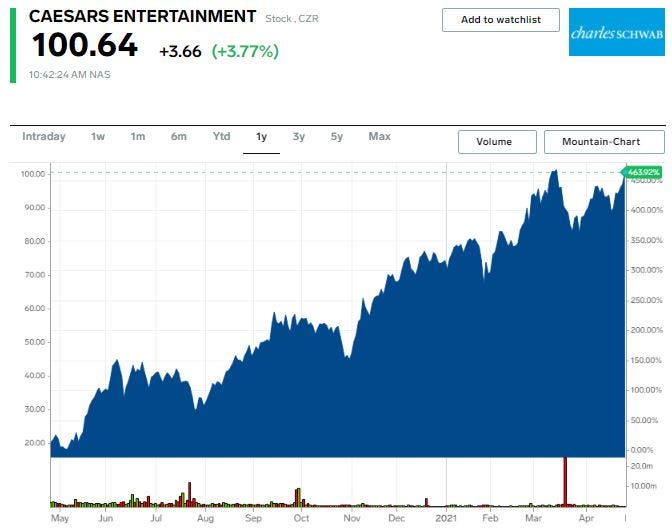

3. Caesars

Ticker: CZR

1-Year Return: 527%

2. L Brands

Ticker: LB

1-Year Return: 548%

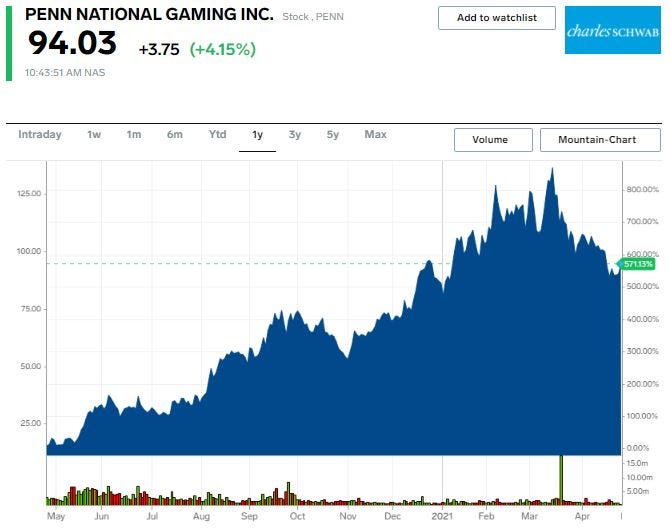

1. Penn National

Ticker: PENN

1-Year Return: 575%